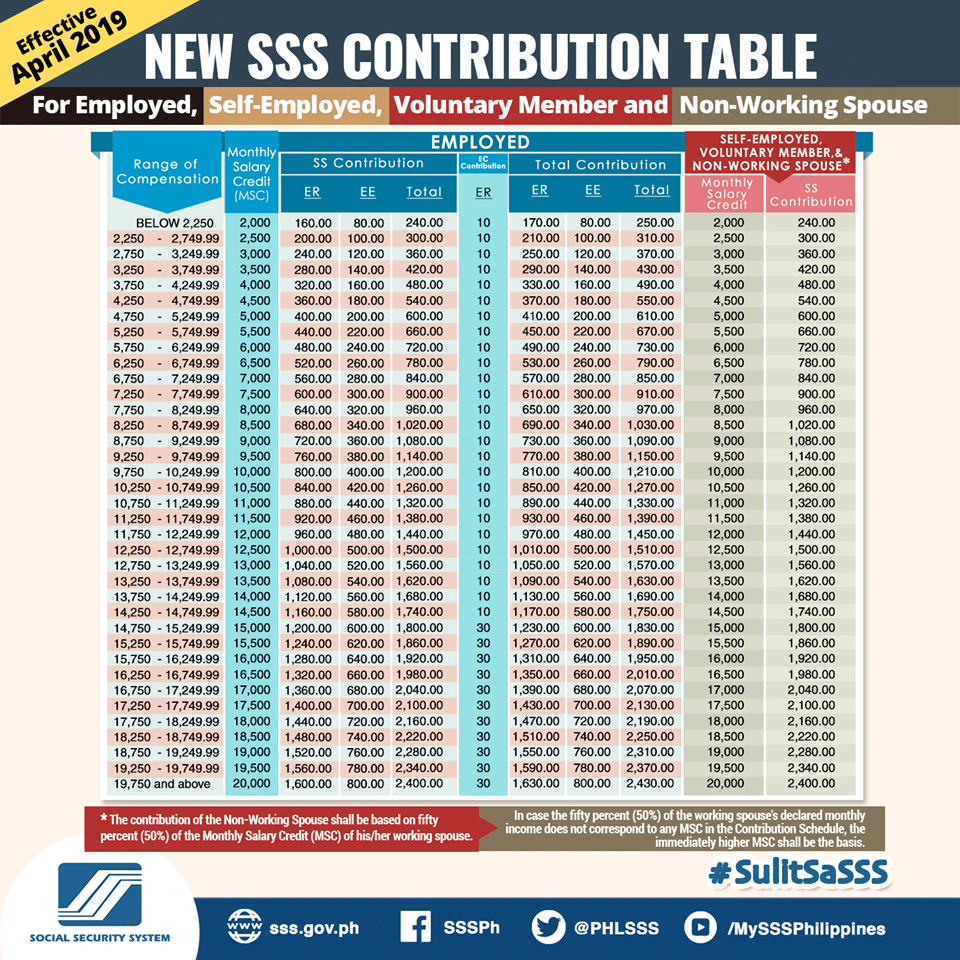

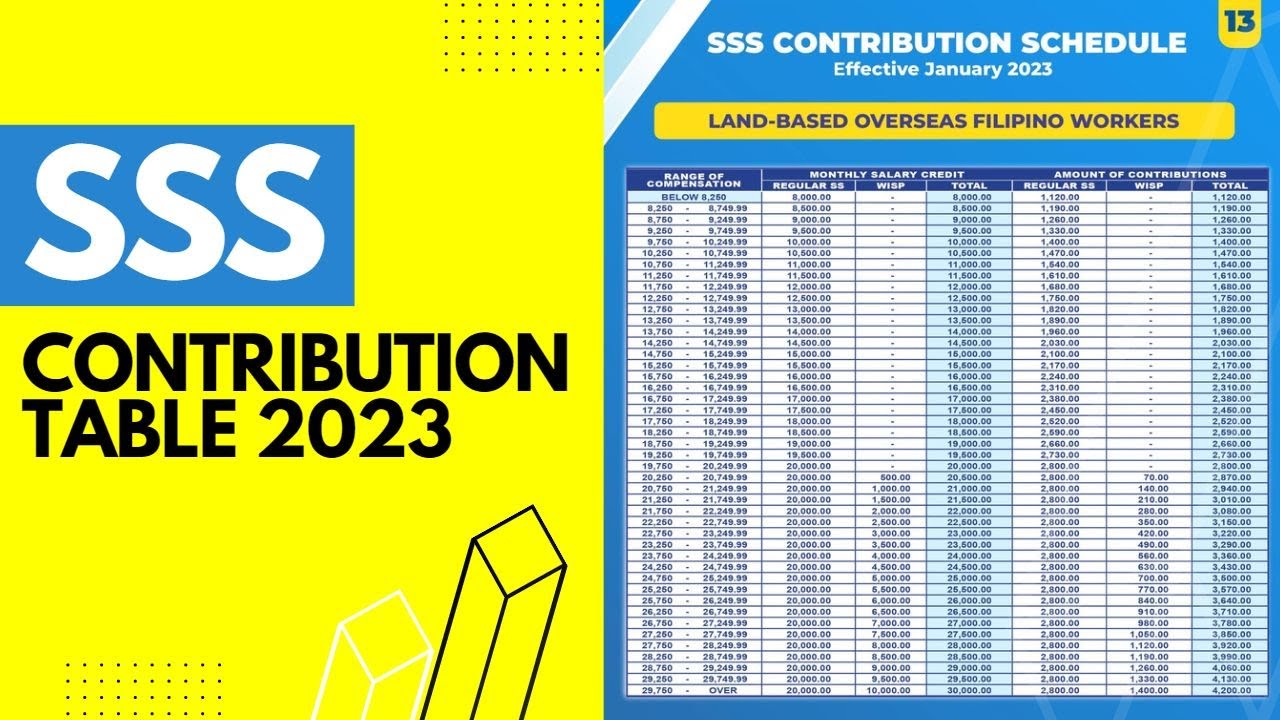

Sss Contribution Table 2024 Self Employed. Based on an sss circular, [2] this is the new schedule of contributions effective january 2023. As you can see, your sss.

Recently, the social security administration announced that the wage base for computing social security tax will increase to $168,600 for 2024, which is up from. Check the updated sss contribution table to see the percentage employees and employers contribute monthly.

New SSS Contribution Table 2023 (Everything you need to know) SSS Answers, Recently, the social security administration announced that the wage base for computing social security tax will increase to $168,600 for 2024, which is up from. Downloadable excel version is available.

5 MustKnow Facts to Claim Your SSS Unemployment Benefit Cash Mart, Downloadable excel version is available. Based on an sss circular, [2] this is the new schedule of contributions effective january 2023.

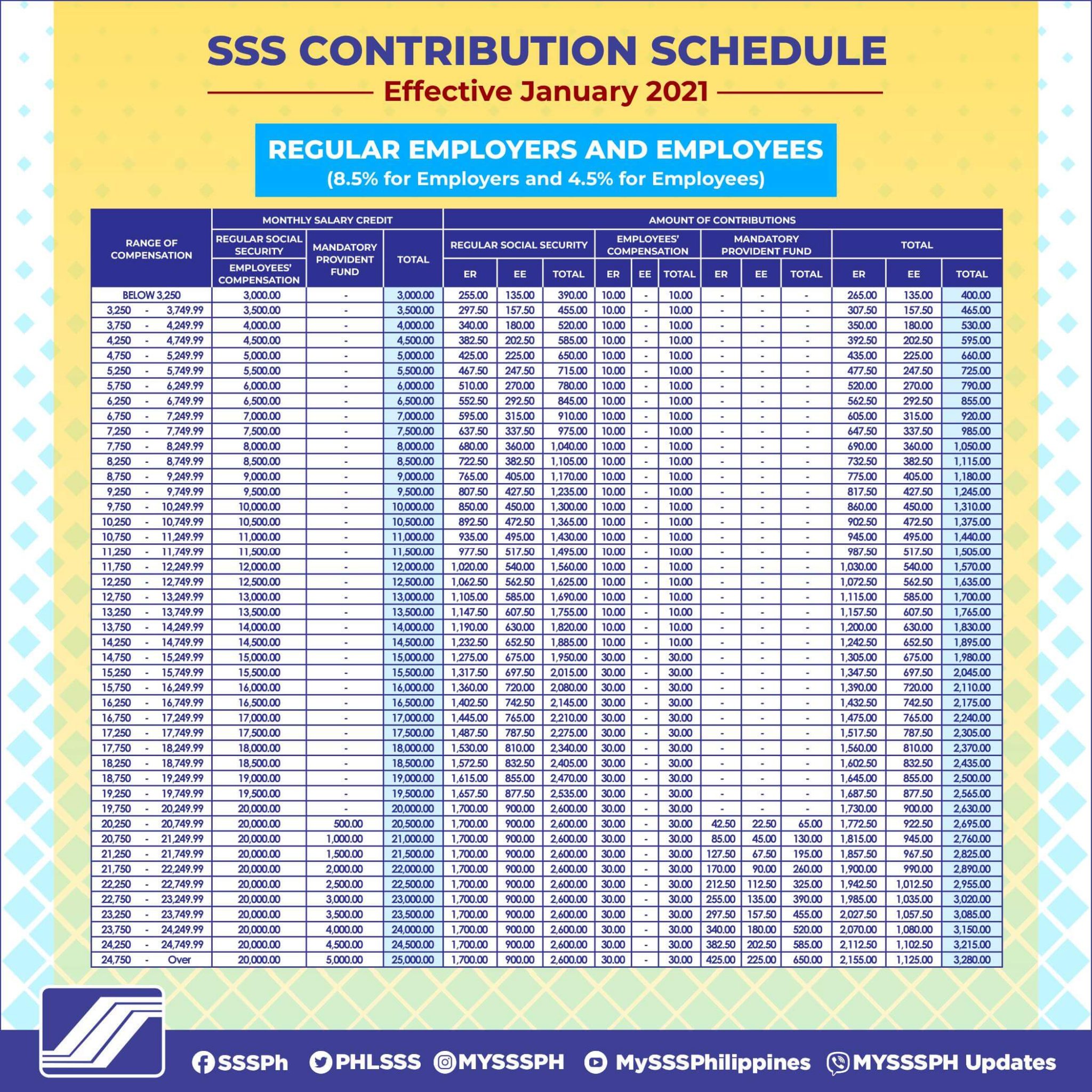

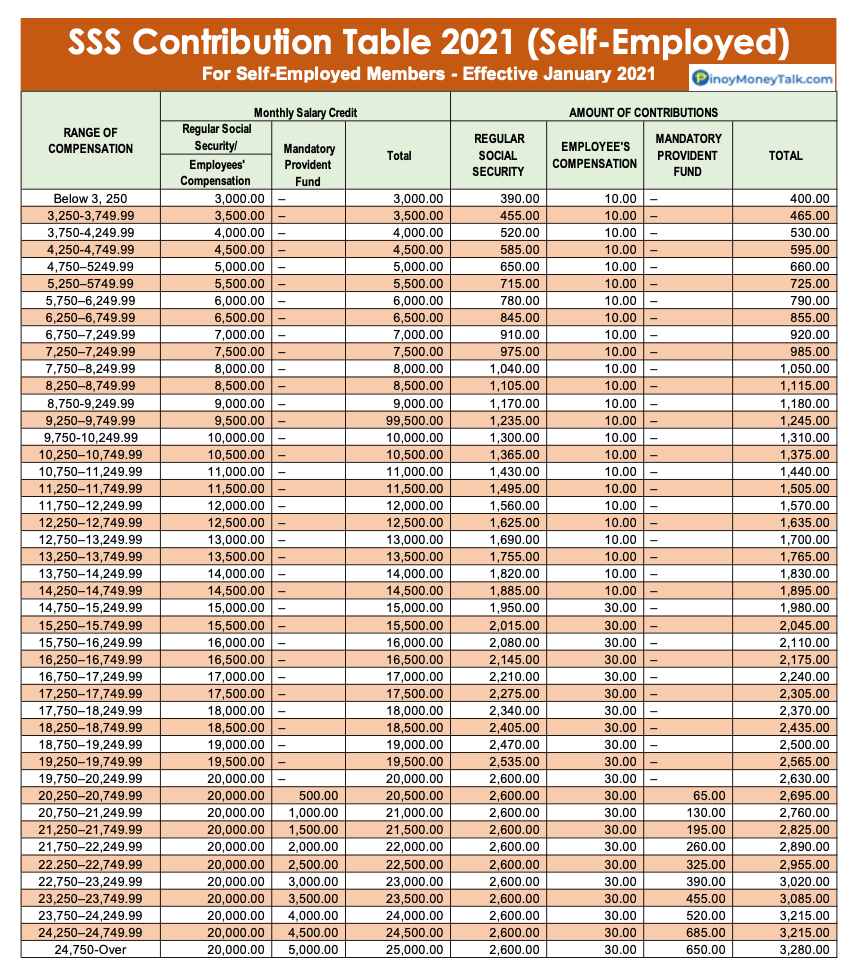

New SSS Contribution Table 2021 Sss, Contribution, Save, The new sss contirbution table for self employed members effective january 2021. The sss periodically updates the contribution table and thresholds based on inflation and fund performance.

What’s New SSS Contribution Table 2021 QNE Software, Register with my.sss at the sss website. On the other hand, the maximum.

SSS Online Registration and Steps to Check SSS Your Contribution Online, The current sss contribution rate is 11% of the monthly salary credit up to p16,000, split equally between the employer (7.37%) and the employee (3.63%). Register with my.sss at the sss website.

Sss Contribution Payment Form For Self Employed Employment Form, If there are any changes to these rates, we will be update them here to keep you in the. Check the updated sss contribution table to see the percentage employees and employers contribute monthly.

Sss Contribution Table For Employees Self Employed Ofw Voluntary, On the other hand, the maximum. Includes 2024 sss, ec, and premium contributions.

Sss Contribution Table Self Employed The Sss Contribution Tables Hot, The new sss contirbution table for self employed members effective january 2021. Below, we outline the current effective contribution rate tables from the sss.

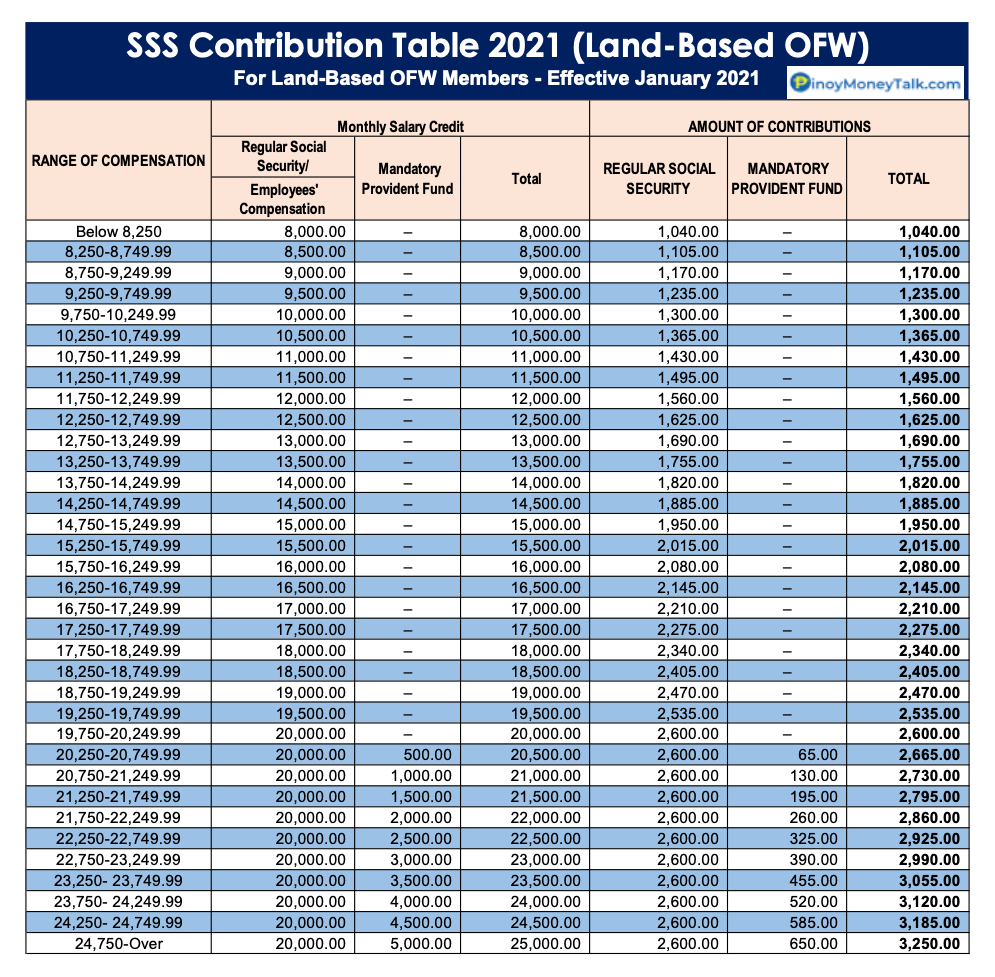

Download 2023 SSS Contribution Table and Schedule of Payments Watch online, For overseas filipino workers (ofws), the minimum msc was increased from p3,000.00 to p5,000.00, beginning 01 january 2004. When you are an sss member you’re covered by its range of benefits including sickness, maternity, disability, retirement, and death benefits.

New SSS Contribution Table 2022 Prewriting activities preschool, Downloadable excel version is available. The sss periodically updates the contribution table and thresholds based on inflation and fund performance.

The current sss contribution rate is 11% of the monthly salary credit up to p16,000, split equally between the employer (7.37%) and the employee (3.63%).

For overseas filipino workers (ofws), the minimum msc was increased from p3,000.00 to p5,000.00, beginning 01 january 2004.